Homeowners Insurance in and around Lake in the Hills

Looking for homeowners insurance in Lake in the Hills?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Lake in the Hills IL

- Crystal Lake, IL

- Village of Lakewood

- Algonquin, IL

- Huntley, IL

- Hampshire, IL

- Marengo, IL

- Carpentersville, IL

- Dundee, IL

- Gilberts, IL

- Cary, IL

- East Troy, WI

- Sussex, WI

- Delevan, WI

- Lake Geneva, WI

- Mukwonago, WI

- Carmel, IN

- Noblesville, IN

- Woodstock, IL

- Oconomowoc, WI

Insure Your Home With State Farm's Homeowners Insurance

Home is where memories are created friends always belong, and you enjoy coverage from State Farm. It just makes sense.

Looking for homeowners insurance in Lake in the Hills?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Open The Door To The Right Homeowners Insurance For You

Agent Mark Krueger has got you, your home, and your possessions covered with State Farm's homeowners insurance. You can call or go online today to get a move on building a policy that fits your needs.

More homeowners choose State Farm® as their home insurance company over any other insurer. Lake in the Hills homeowners, are you ready to find out what a State Farm policy can do for you? Get in touch with State Farm Agent Mark Krueger today.

Have More Questions About Homeowners Insurance?

Call Mark at (847) 515-2600 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.

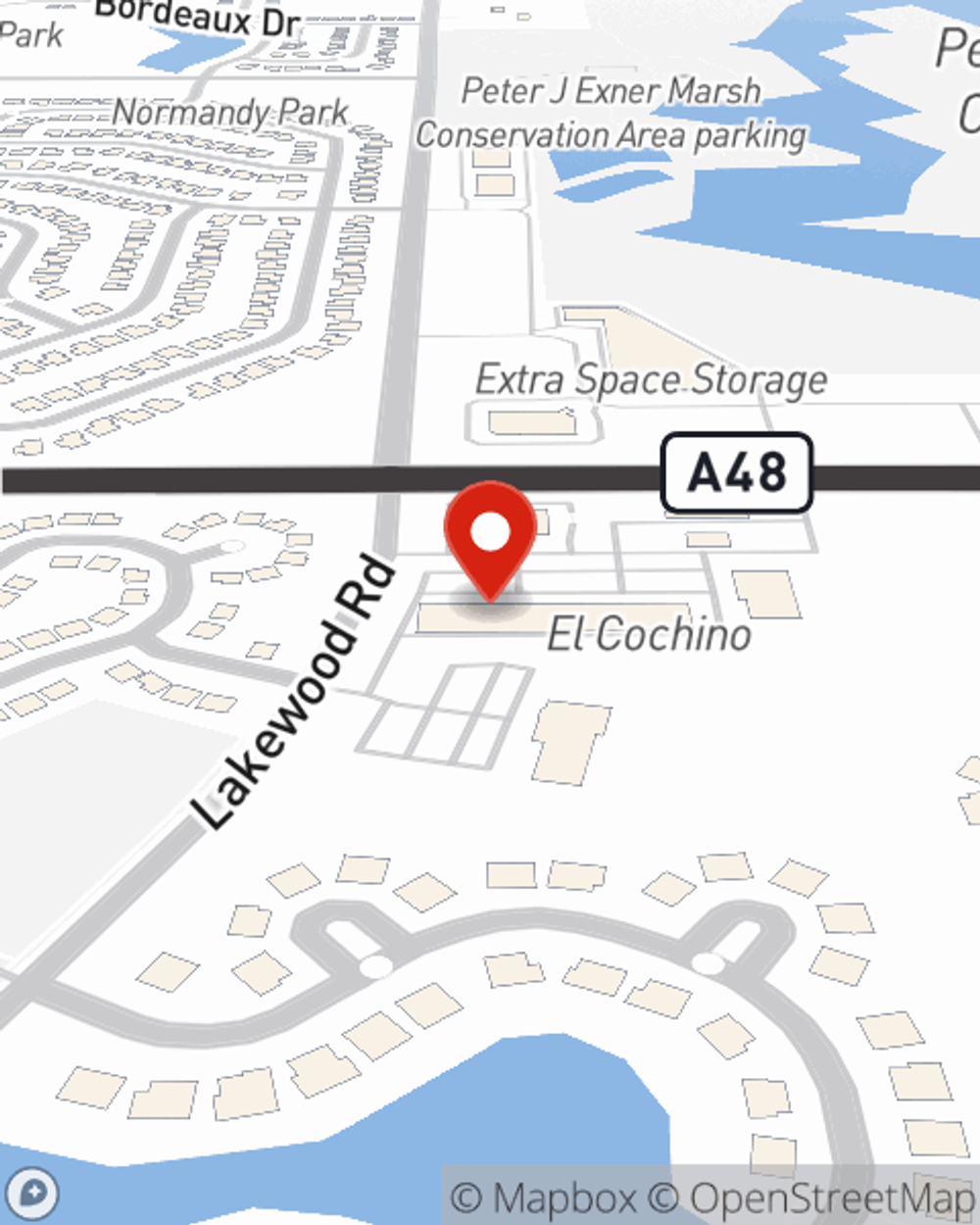

Mark Krueger

State Farm® Insurance AgentSimple Insights®

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.